Insure Your Life Reclaim Future

Protection that pays you back

Safety net with a refund!

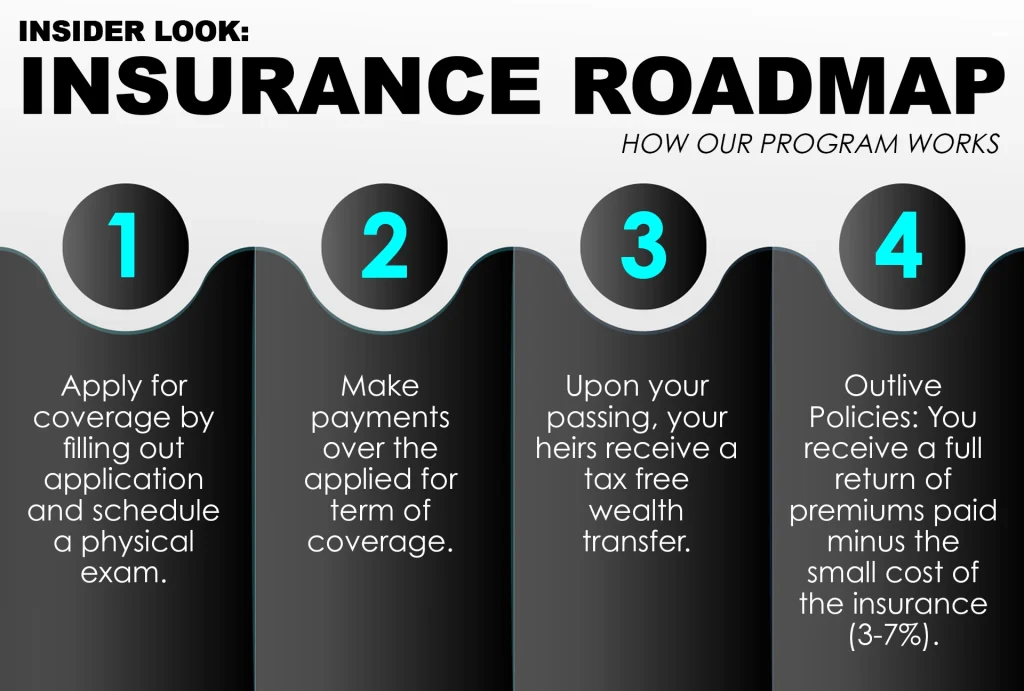

**Return of premium value is net of insurance charges and may not equal 100% of premiums paid. Average costs of insurance is usually 3-7% *

“Someone's sitting in the shade today because someone planted a tree a long time ago”

A Team You Can Trust

With agents licensed around the country, and relationships with top carriers in the nation, we find the best coverage to suit your needs